It is no great surprise to read that the media industry will face a number of ‘significant challenges’ in this New Year. For What’s New in Publishing, Journalism professor Damian Radcliffe addresses some of the biggest trends companies are likely to encounter in publishing in 2023. Spotlighting five charts, he shows the potential impact of changes in the ad market, pressures on consumer spending and evolving media habits and preferences.

Advertising

The picture in 2023 may not be as bleak as many feared

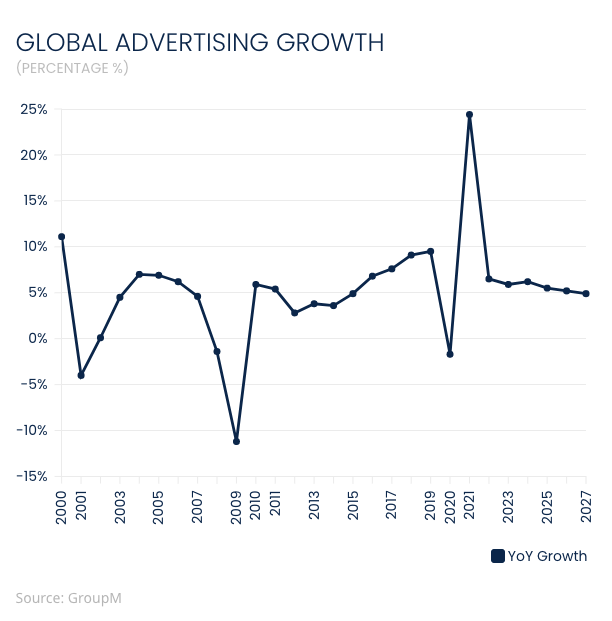

The headlines in the advertising trade press have been gloomy, focused on the gradual downgrading of growth in global spending forecasts. The most recent predictions for 2023 have dropped to 5.9%, down from the 6.4% estimated by Group M in June 2022.

Radcliffe points out, however, that a longer term look shows steady advertising growth. Group M estimates the three-year compound annual growth rate for total advertising spend from 2019-2022 is 8.8%. This rate of increase is almost identical to the 8.7% growth rate recorded from 2016-2019.

Subscriptions

A real bright spot for publishers

Current growth rates in subscriptions are, like advertising, slowing. However, although growth figures are significantly down from the same time last year, data from FIPP’s Q3 2022 Global Digital Subscription Snapshot shows period-on-period increases for many brands remains at a healthy 5% or more.

Lower growth will see publishers increasing retention efforts and innovating to deliver increased subscriber value. These efforts will become increasingly important as pressures on reader revenue increase with rising cost-of-living pressures. Radcliffe suggests keeping an eye on your competition to see how they implement their subscription strategies.

Digital Subscribers. Source: FIPP

Rebuilding trust

Trust remains fundamental

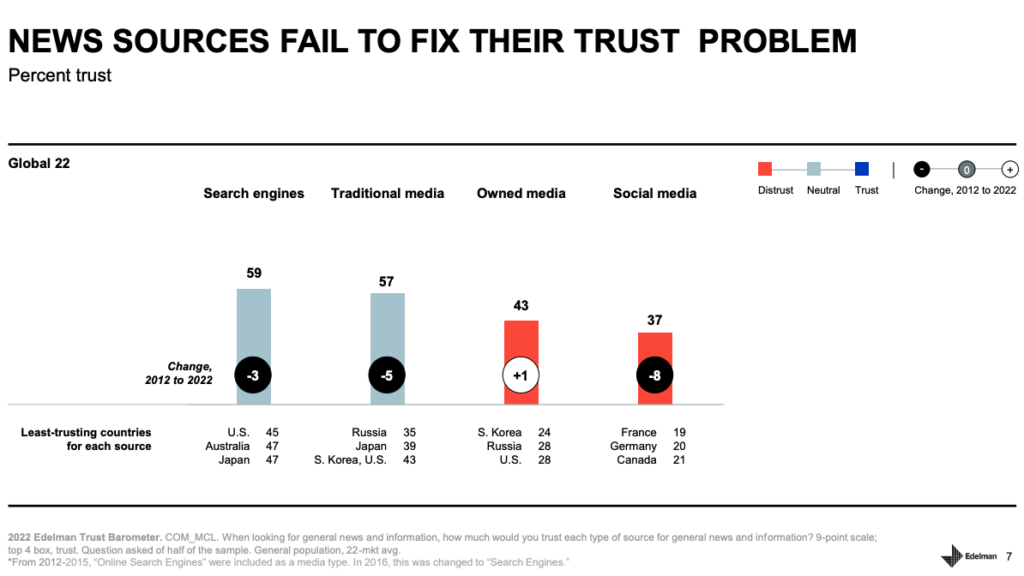

The erosion of trust in the media has been a growing problem for some time. The 2022 Edelman Trust Barometer reported that, rather than trusting the media, 46% of respondents surveyed across 28 markets saw the media as a divisive force. Without trust, neither subscribers nor advertisers are likely to invest in a media brand; audiences want to be able to have faith in the accuracy of the content they read and want to be associated with reputable information.

To begin fixing the trust problem, publishers should make their content more accessible and easier to understand. They should embrace a range of formats and styles including journalism that highlights solutions, not just problems. Radcliffe points to initiatives like the Trusting News project for guidance that publishers can apply in a rebuilding trust strategy.

Source: Edelman

Reaching Gen Z

Speak to them directly

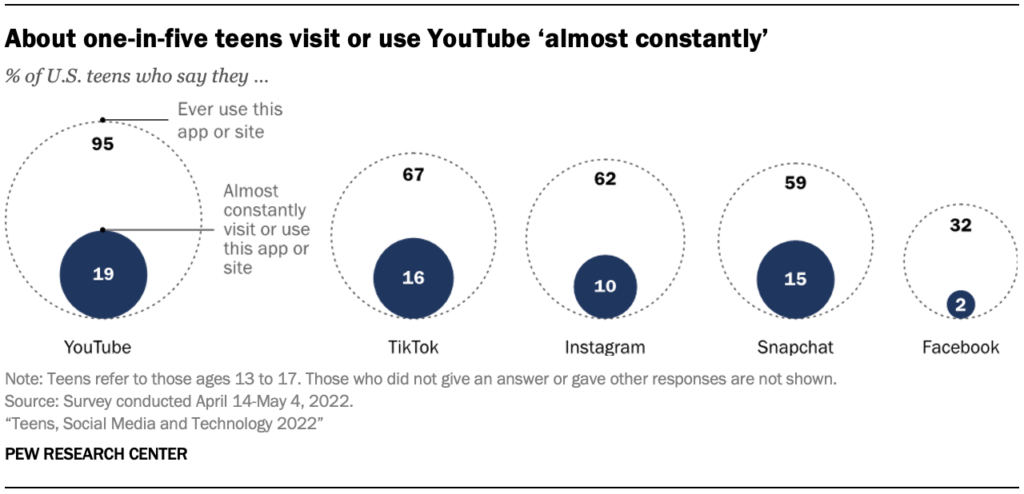

Reaching younger audiences is the holy grail for many publishers – the next subscriber cohort, Gen Z is also attractive to advertisers. But they are a unique audience, consuming content differently than older groups. Video platforms like YouTube and TikTok, as well as music streaming services, account for a large percentage of their media time.

Radcliffe suggests publishers should meet Gen Z where they are, communicating in ways that speak to them. He said that means creating tailored products, hiring and empowering Gen Z talent, and engaging with audiences off-platform on YouTube, TikTok and Instagram.

Source: Pew Research Center

Leveraging engaged time

A firm foundation to build on

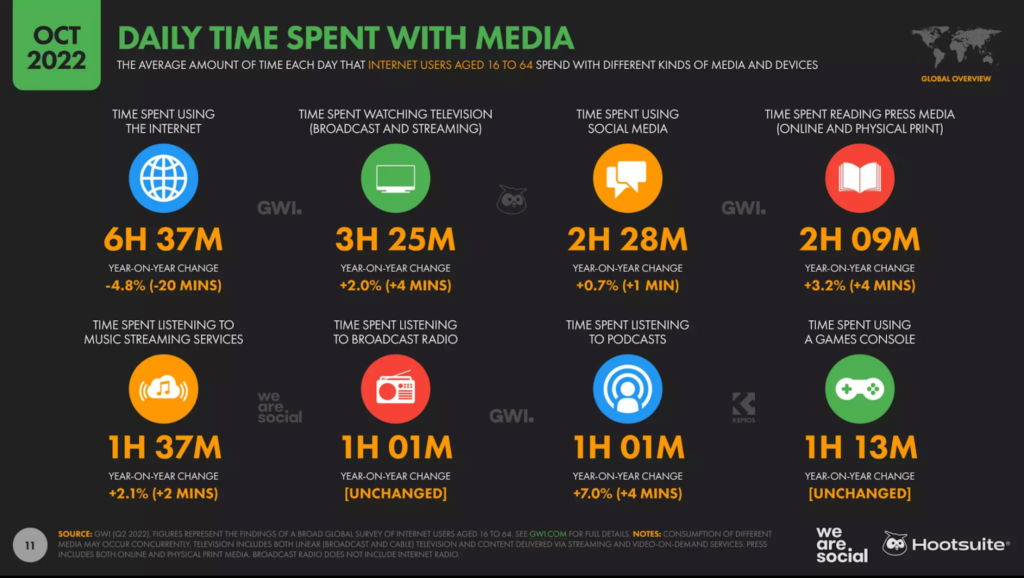

According to research from Datareportal, the average internet user spends 2 hours 9 mins a day on published content. This is slightly less than social media (2 hours 28 mins), but more than many might expect. Radcliffe describes this as a firm foundation for publishers to build on in 2023. They must engage their audiences, leveraging that engagement to build ‘product, advertising and reader revenue strategies’ that tap into defined consumption habits.

Source: DataReportal