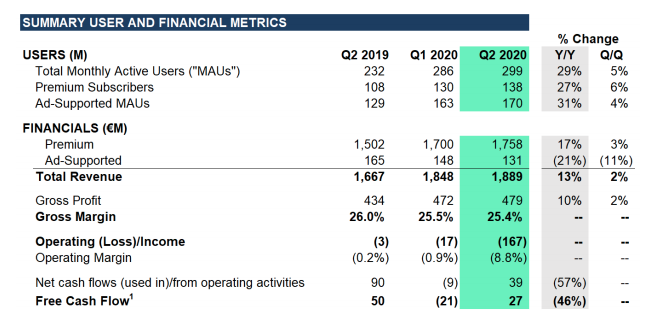

Spotify released healthy consumption numbers and a rise in paid subscribers despite a pandemic-driven net revenue loss of $420 (€356) million in its Q2 report this week. Total revenue of €1.89 billion grew 13% YOY in Q2.

The takeaways

Via Spotify.

- Q2 ad-supported revenue declined 21%, while monthly active users rose 29% to 299 million.

- Paid subscriber numbers rose 27% YOY to 138 million, beating Wall Street estimates of 136.4 million.

- Spotify’s shares fell 3% to $253 before the U.S. market opened, having risen around 80% since the beginning of this year.

By the numbers: Interestingly, actual podcast content consumed more than doubled and listening hours bounced back to their pre-pandemic levels. Reportedly, the recovery was greatest in areas showing a slowdown in coronavirus spreading, including Asia and Europe.

- Revenue was up 13% to €1.89 billion euros for the three months ending June 30, missing analyst estimates of €1.93bn.

- Average revenue per user (ARPU) for Q2 fell by 9% a year ago to 4.41 euros.

- The Wall Street Journal identified a small increase from 19 to 21% in monthly active podcast listeners.

- Latin America, one of Spotify’s fastest-growing regions yet 6% below peak COVID-19 levels, gained a 33% rise in monthly active users year-over-year. The Rest of World also delivered fast-growing active user results at 58%.

The outlook:

- “We continue to see positive growth in our Streaming Ad Insertion (“SAI”) technology, which will be more widely available to US advertisers this summer. Our latest podcast advertising innovation involves In-App Offers powered by SAI, which resurfaces offers to podcast listeners

with a visual reminder, allowing listeners to redeem offers in-app when the time is right for them.” - “Overall, podcast advertising outperformed in the quarter with momentum continuing into July. Additionally, we announced a $20 million advertising partnership with Omnicom Media Group which we believe is the largest global, strategic podcast advertising partnership to-date.”

- Spotify anticipates reaching its full-year financial targets. It also expects total Q3 premium subscribers to reach 140-144m.

The company’s podcasting business is growing, particularly after purchases like its exclusive deal with The Joe Rogan Experience. Nevertheless, podcasts remain a relatively small part of Spotify’s overall revenue.