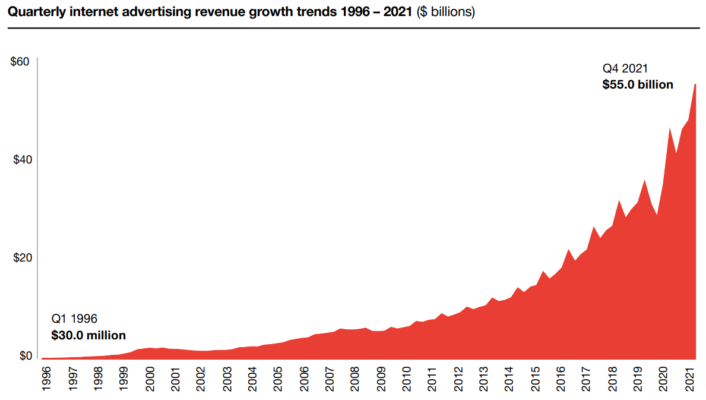

According to the latest full year Internet Advertising Revenue Report by IAB and PWC, total US digital advertising revenue for 2021 came to almost $190 billion. Although a strong increase was expected post-pandemic, the report sees ‘exponential growth’ and is optimistic for the longer term, saying the trajectory in recent years suggests there is no slowing down for the industry.

Takeways

- The year’s $50 billion increase, representing YOY growth of more than 35%, is the highest jump in digital advertising spend since 2006. Revenue was up in every digital channel, with some showing YOY increases of more than 50%.

- Revenue growth remained consistent throughout 2021. The second half of the year accounted for $102 billion of the annual total, with the rate of growth exceeding Wall Street expectations, according to the report.

- The revenue jump is three times the previous year’s growth rate of 12.2%, and twice the increase posted in 2018 – 2019. Libby Morgan, chief strategy officer at the IAB said:

We fully expected 2021 to be an exceptional year for digital ad growth, but even we were surprised at the degree of acceleration.

Growth factors

The factors behind ‘exponential growth’ in the digital advertising sector include increases in the consumption of digital media, significant growth in ecommerce and an increase in the number of smaller business engaging with digital advertising.

- Total ecommerce revenues were up by 50% in 2021, reaching $870 billion, according to the US Department of Commerce. In the final quarter of the year, powered by holiday-season shopping, ecommerce spending topped $55 billion, the highest quarterly total ever recorded.

- According to the US Census Bureau, 2021 also brought the highest rate of business start ups on record, with 5.4 million businesses launched. The report highlights the reliance new businesses place on the ‘ad-supported internet’ to attract customers and increasingly delivers products and services.

- David Cohen, CEO of the IAB saw this as an opportunity for local or regional publishers to increase their advertisers base. He said:

We believe this small business engine will be a key contributor to fueling ongoing digital media and marketing ecosystem growth.

Growth areas

Digital audio ad revenues grew 57.9% YOY, the strongest growth in the leading digital ad formats. Total audio revenues reached $4.9 billion, a jump of $1.7 billion for the year.

Digital video ad revenue saw the second-highest rate of growth in 2021 at 50.8%, YOY, to total $39.5 billion.

Search advertising retained the highest share of total digital advertising spend at $78.3 billion, bur with a comparatively low growth rate at 33%, YOY.

Display

recorded the second-highest share of spend at $56.7 billion, but grew just 29%, YOY.

Social media advertising was up 39.3% to $57.7 billion, YOY.

Programmatic advertising revenues increased by 39%, YOY, to reach $27.8 billion

Continued growth

Growth in the digital advertising sector is consistent with the findings of a recent by Harvard Business School, commissioned by IAB, which showed the internet economy growing seven times faster than the US economy over the past four years. It now accounts for 12% of the US GDP.

The IAB believes increased consumer usage alongside unprecedented growth of small and mid-sized businesses during the pandemic has powered growth across all digital channels. It is also forecasting continued digital ad growth across the board.

Cohen sees a ‘clear narrative’ in the numbers, what he calls a democratization of access afforded by ad-supported digital channels. He said:

We expect this digital migration to drive the continued growth of a healthy and competitive digital marketplace driven by innovation and entrepreneurship.