The takeaways

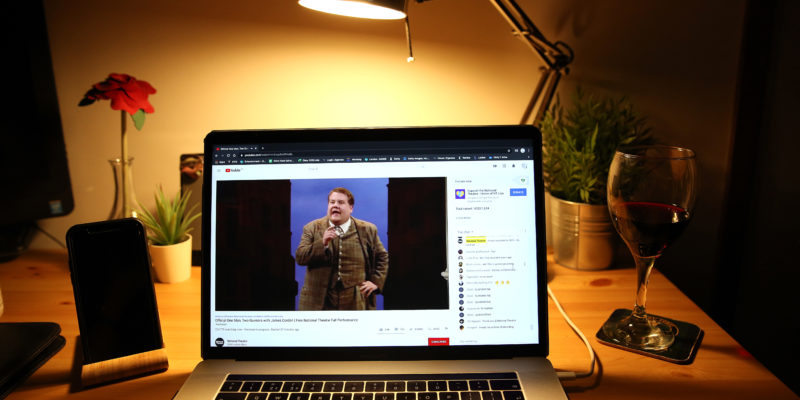

- YouTube TV announced its monthly subscription fee has increased to $65.00, $30 more than its debut price in 2017.

- The price hike came after the Google-owned platform outlined potentially lucrative ad initiatives.

- This highlights a trend of streaming subscriptions growing on par with traditional TV packages, even as subscribers desert the latter for “skinny streaming bundles”.

What happened?

Last month, YouTube’s ninth annual NewFronts presentation virtually addressed its traditional audience of digital advertising buyers today via its new format, “Brandcast Delivered”. Since then, the platform has raised its YouTube TV prices despite acknowledging the coronavirus pandemic’s effect on consumer subscriptions.

The subscription increased from $40 per month to $65, on par with a cheap cable option (depending on the provider). On debuting in 2017, the monthly fee was $35. YouTube blamed the increases on new additions like PBS and Discovery Network brands including Food Network to its lineup.

Although cash-strapped subscribers can pause or cancel their payments, YouTube clearly considers price hikes a reliable business tactic even now. At the same time, sports livestreaming service ESPN+ was reported to be raising monthly fees from $4.99 to $5.99. Both packages rely on streaming live sports to attract consumers, which the pandemic has ultimately put a stop to.

By the numbers

YouTube TV numbers 2 million paid subscribers and is currently diversifying its original content amid impressive company results. In the past year, YouTube overall delivered almost 1 billion conversions, driven primarily by video ads.

Additionally, YouTube log-ins recently numbered over 2 billion monthly users, and an estimated 100 million+ monthly viewers watched its videos on TV sets in March. An ad rating study by Nielsen found that YouTube’s target audience reach was incremental to that of television. In comparison, the U.S.’s largest cable provider, Comcast, has over 20 million cable subscribers.

Recent data shows the top pay-TV providers (Comcast, Charter, Dish and AT&T) lost 5.4 percent of subscribers in 2019 compared to 1.7 percent in 2018, partly due to increased streaming options. Overall, paid TV bundles declined by almost 5 million in 2019. Now Q1 2020 video subscription declines are estimated at 2.1 million.

What it comes down to is this: streaming services and cheaper bundles are also moving incrementally like their television counterparts. In time, it could be tougher to distinguish streaming’s monetary value from cable even as the former seeks to overtake the latter.