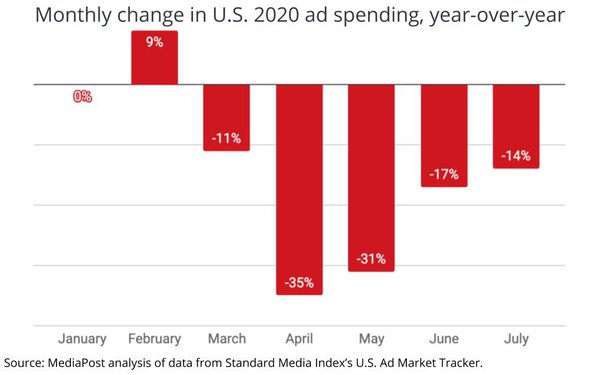

The ad market in the U.S. has been hit hard by the coronavirus pandemic, but is showing signs of recovery as July figures have been released. Programmatic advertising in particular appears resilient, although growth has been severely stifled.

The takeaways:

- U.S. ad spending declined 13.9% vs July 2019, according to the U.S. Ad Market Tracker. Compared to an 11% drop in March, a huge 35% decrease in April and a 31% drop in May, this is the lowest rate of decline since the economic effects of the pandemic kicked in.

- Programmatic advertising spend in the U.S. is expected to grow just 6.2% this year compared to pre-pandemic predictions of 19-22%. A strong bounceback is expected in 2021, although this depends on how prolonged the recession ends up being.

- Mobile advertising has shown strong growth in the UK, despite the pandemic, with a survey finding that almost half of all marketers are allocating over 25% of their marketing budgets to mobile.

Putting it in perspective: According to a MediaPost analysis of the index data, ad spending is actually proving more resilient than the decline in the national economy.

- U.S. GDP fell 19% in the first half of 2020, but the ad industry only contracted 14.4%.

- The largest U.S. advertisers and digital media ad spend are buoying the market, with these areas showing growth in July.

Uneven growth: Some segments are driving programmatic far more rapidly than others, according to eMarketer.

- Mobile spending is projected to rise by $3.93 billion this year, a 9% increase.

- Connected TVs are set to see the biggest growth in spend, with a 35.5% change in 2019. Video and non-social channels are also expected to see strong overall growth.

- Desktop and laptop will see an -11.3% contraction in programmatic spend, despite an increase in homeworking and laptop usage.

Also worth noting is that programmatic ad transactions will make up 84.5% of the digital display ad market in 2020, up slightly on 83.9% in 2019.

The publisher point of view:

Ad sectors have not been affected evenly by the downturn, with some areas seeing strong growth, and others sharp declines. The Wall Street Journal opened up to Digiday about their own recent experiences with the ad market:

- “We’ve had a lot of great digital ad momentum lately,” said Chief Revenue Officer Josh Stinchcomb. “We’ve had growth for the last four out of six quarters.”

- 65% of the WSJ’s ad revenue is B2B, a sector that has mostly held up during the crisis. They have also seen a recent “surprising” bounceback in high-end residential real estate, which is helping B2C back on its feet.

- Internally, the publisher has focused on high-touch custom solutions and data-driven programmatic to weather the storm. Their private marketplace revenue has grown over 50% in the last year, and CPMs have grown 15% as a result of investment in their first-party data collection and ad tech.

Yes but: It’s not been easy for many other publishers. Despite digital subscription success, The New York Times has seen digital ad revenue fall 32% across the company, in line with wider market declines.