The takeaways

- #StopHateforProfit’s Facebook ad boycott continues despite a “disappointing” meeting with its leadership.

- The company implemented changes to curb racism and misinformation, but otherwise continues as normal with a 4% share price rise.

- Changes appear more influenced by publicity than financial pressures.

What happened?

Since #StopHateforProfit’s Facebook advertising boycott began, its organizers labeled their meeting with CEO Mark Zuckerberg “deeply disappoin[ting].” Jessica J. González, co-CEO of co-organizer Free Press, accused Facebook of approaching the meeting “like a PR exercise.” A two year-long independent audit also critiqued Facebook’s “serious setbacks to civil rights.”

The report praised a ban on discriminatory and nationalistic content. But Facebook’s lacking political moderation “leave[s] the door open for the platform to be used by other politicians to interfere with voting.” A possible political ad ban on Facebook before November’s U.S. elections was later reported.

Oversight delays

Facebook’s independent Oversight Board, which will influence policy and moderator decisions, won’t launch before late fall. After nonprofit Accountable Tech campaigned for the board to demand more policy authority, board appointee Alan Rusbridger spoke to the BBC. Rusbridger stated that Facebook is recruiting from an ethnically and geographically diverse pool. Such candidates include “lawyers, human rights activists, academics, journalists [and] troublemakers.“

Pressure, public relations and new products

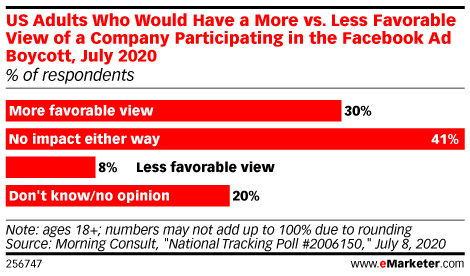

Via eMarketer.

Both market analysts and Zuckerberg expect little financial impact from the boycott and Facebook shares have since grown around 4%. Boycott organizer and Color of Change President Rashad Robinson told Barron’s that instead of dumping Facebook stock, investors, like advertisers, should question if they want to profit from a platform hosting “white nationalists’ content.” In other words, #StopHateForProfit expects to make changes on ethical and public sentiment grounds.

A Financial Times article this week described Facebook using “a mixture of perks and pressure” to retain its top advertisers’ business. Yesterday, it published a rebuttal by David Fischer, Facebook’s Chief Revenue Officer.

Meanwhile, the company reportedly launches Instagram Reels in over 50 countries, including the U.S., next month. Also forthcoming are Instagram Shop for brands and creators, and Facebook Pay, which enables transactions across all Facebook platforms.